Read the report: How have workplace saving behaviours changed during high inflation? (PDF)

Auto enrolment into workplace pensions has brought millions of UK workers into regular retirement savings. Most of these savers are enrolled at the national minimum contribution rate of 8% – a rate that’s seen by many as too low to provide for an adequate level of income in retirement.

We already know it’s unusual for people to change the contribution rate at which they’re auto enrolled. This means that 8% has effectively become the norm for auto enrolment – the default contribution level for the vast majority of people. This is why we’re seeing increasing calls in policy circles to increase that 8% minimum. If people won’t take action to increase their savings by themselves, doesn’t government need to do this for them?

Driving up contributions would of course help address the under-saving of some, but what about those who are already saving enough? And what about those who, even at the minimum pension contribution rate, may be struggling to make their income meet their day-to-day needs? Our new research into the savings behaviours of Nest scheme members during the recent period of high inflation, sheds light on the contribution behaviours of people facing affordability challenges: How have workplace saving behaviours changed during high inflation? (PDF). The research was carried out with researchers at the University of Nottingham and Warwick Business School, with the generous support of the Nuffield Foundation.

It would be easy to assume that when a default contribution rate is increased, people who can’t afford the additional cost will stop paying contributions. And they would also opt out when they were next enrolled. By the same logic, if contribution rates remained the same, but the cost of living increased, people would take similar actions to reduce their costs. Our research questions this assumption by examining savings behaviours in Nest during a period of historically high inflation.

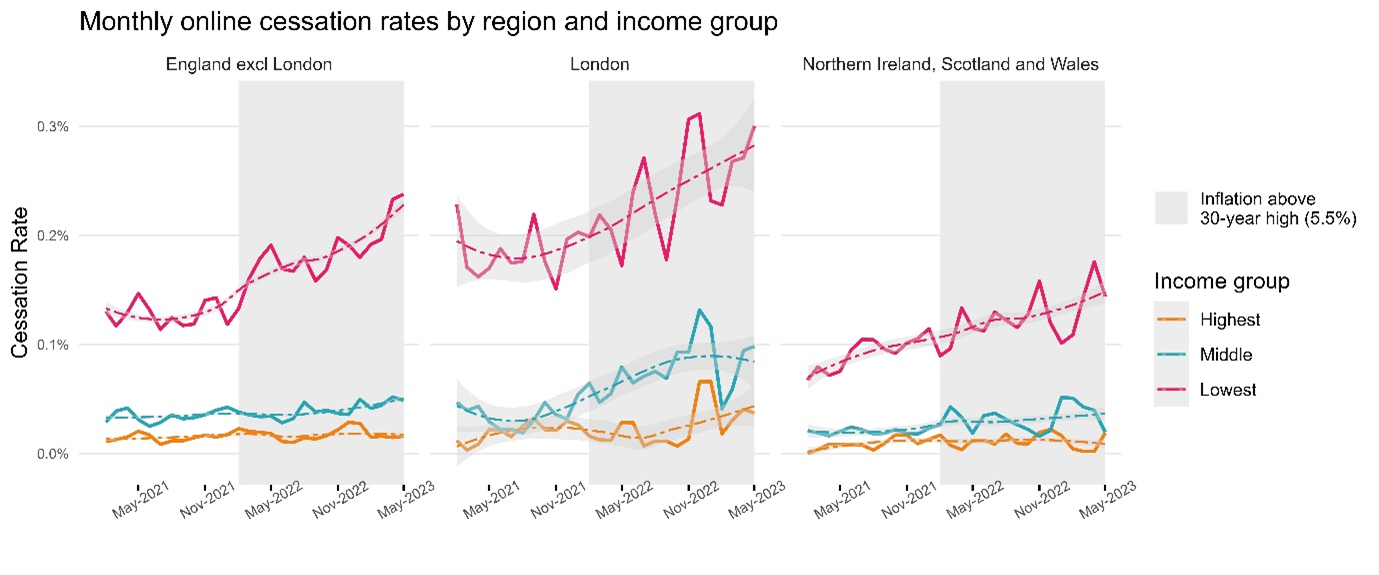

We found that the vast majority of Nest members did not change their behaviour, even during months of double-digit inflation. While those under the most financial pressure were more likely to take action such as pausing contributions, overall numbers of people changing their pension contributions remains very low across all income groups – even at this time of historically high inflation.

All of this might give cause for concern when we consider previous research[1], showing that an increase in pension contributions could drive some of the UK’s lowest earners to either pause contributions completely, or to rely more heavily on credit or expensive borrowing to cover the cost of sudden expenses such as replacement tyres or new school uniform.

This is why, if minimum contribution rates are raised in the future, we believe an additional ‘safety valve’ may be needed, especially for those on lower earnings. One promising option could be to incorporate an accessible emergency savings scheme into pensions auto enrolment. At Nest Insight we’ve trialled workplace emergency savings extensively with some hugely encouraging results. This would help people build a financial buffer alongside their retirement savings, which may bring them more benefits – especially at this time of high prices and bills. At our recent reception in Westminster, we heard strong political consensus to explore this approach, alongside positive accounts from employers who have trialled opt-out emergency savings for their workforce. We’ll be looking at this further in the coming months.

Matthew Blakstad, Analysis Director at Nest Insight

If you’re looking to answer a question around the dynamics of household finances, or you have data that could help us do so, please get in touch: insight@nestcorporation.org.uk

[1] nestinsight.org.uk/how-much-are-uk-workers-really-saving-as-a-result-of-pensions-auto-enrolment

Read the report: How have workplace saving behaviours changed during high inflation? (PDF)